Financial operations are reaching a point where incremental improvement no longer delivers meaningful clarity or control. As transaction volumes rise, settlement windows shrink, and regulatory expectations tighten, finance leaders are being pushed to rethink how work actually gets done inside finance teams.

This shift has led to growing interest in autonomous finance, not as a futuristic idea, but as a practical response to mounting operational pressure and decision complexity.

Why Traditional Finance Workflows Are Starting to Break Down

Many finance teams still rely on fragmented systems, manual interventions, and delayed reporting cycles to manage increasingly complex operations. Even with automation tools in place, professionals are often forced to reconcile data across platforms, validate outputs manually, and resolve exceptions under tight timelines. These inefficiencies quietly increase operational risk while limiting the function’s ability to support the CFO’s strategy with confidence.

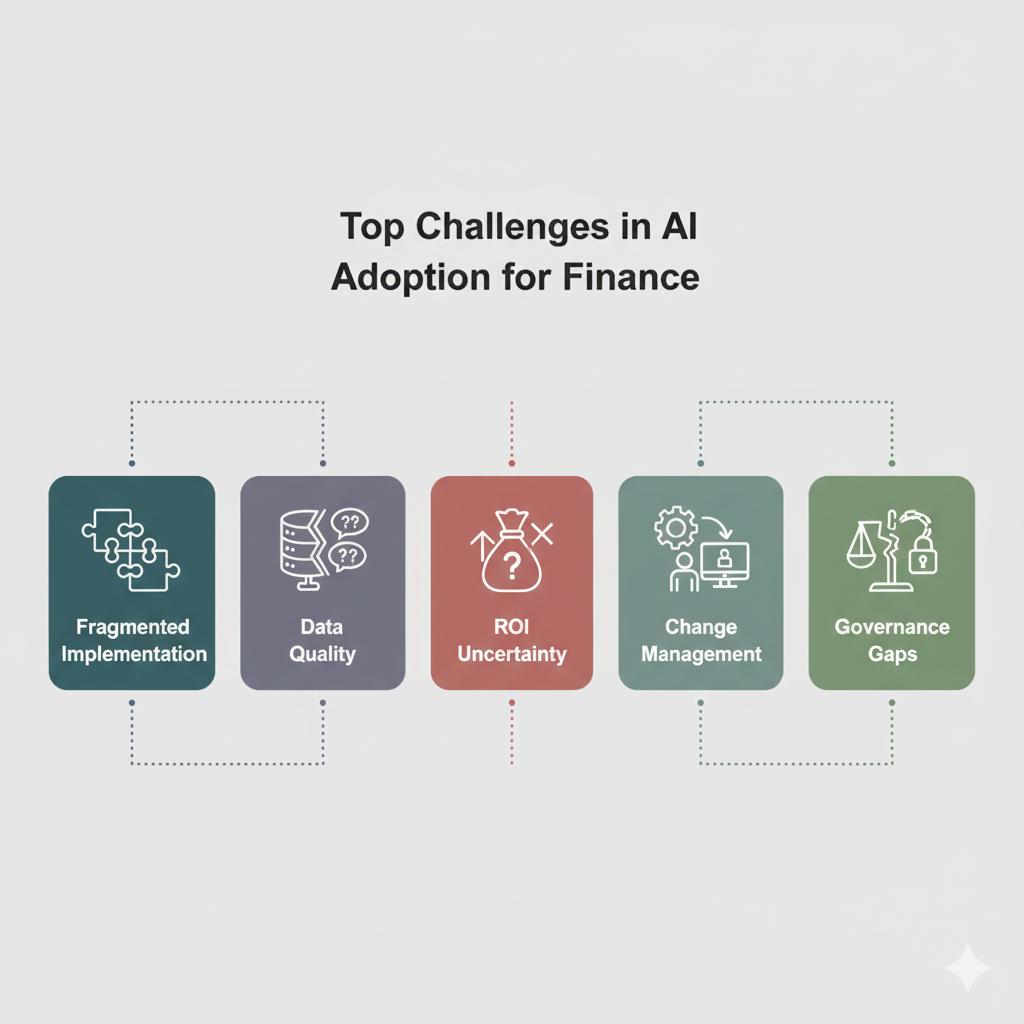

The challenge becomes more visible when finance automation AI is applied only to isolated tasks rather than across connected workflows. Disconnected implementations may improve efficiency in pockets, but they rarely improve forecasting accuracy, liquidity visibility, or decision reliability at the enterprise level. As a result, teams feel busy without feeling in control, and leadership struggles to link technology investments to measurable outcomes.

How Finance Has Evolved Toward Intelligent Systems

According to McKinsey’s 2025 finance AI research, 44 percent of CFOs reported using generative AI across five or more finance use cases, with real-time forecasting and scenario analysis among the most common applications, highlighting a clear move toward continuous insight rather than periodic review.

Source: McKinsey & Company 2025

What Makes Autonomous Finance Different From Automation?

Autonomous finance is often confused with automation, yet the difference lies in intent and intelligence.

Traditional automation executes predefined steps when conditions are met, which works well for stable, repetitive tasks, but struggles when judgment, uncertainty, or exceptions arise. Self-learning finance systems or AI-native financial operations, by contrast, adapt to changing inputs and evolving patterns while remaining aligned with policy and oversight requirements.

Research from 2025 shows that finance leaders expect agentic AI adoption to increase sixfold within the next year, reflecting demand for systems that can operate across interconnected processes rather than single tasks.

Source: Wolters Kluwer 2025

How Does Autonomous Finance Support CFO Strategy?

Autonomous finance strengthens CFO strategy by shifting finance from a reporting function to a decision support function. When intelligent finance systems monitor liquidity, risk exposure, and operational performance continuously, leaders gain earlier visibility into issues that previously surfaced too late to influence outcomes.

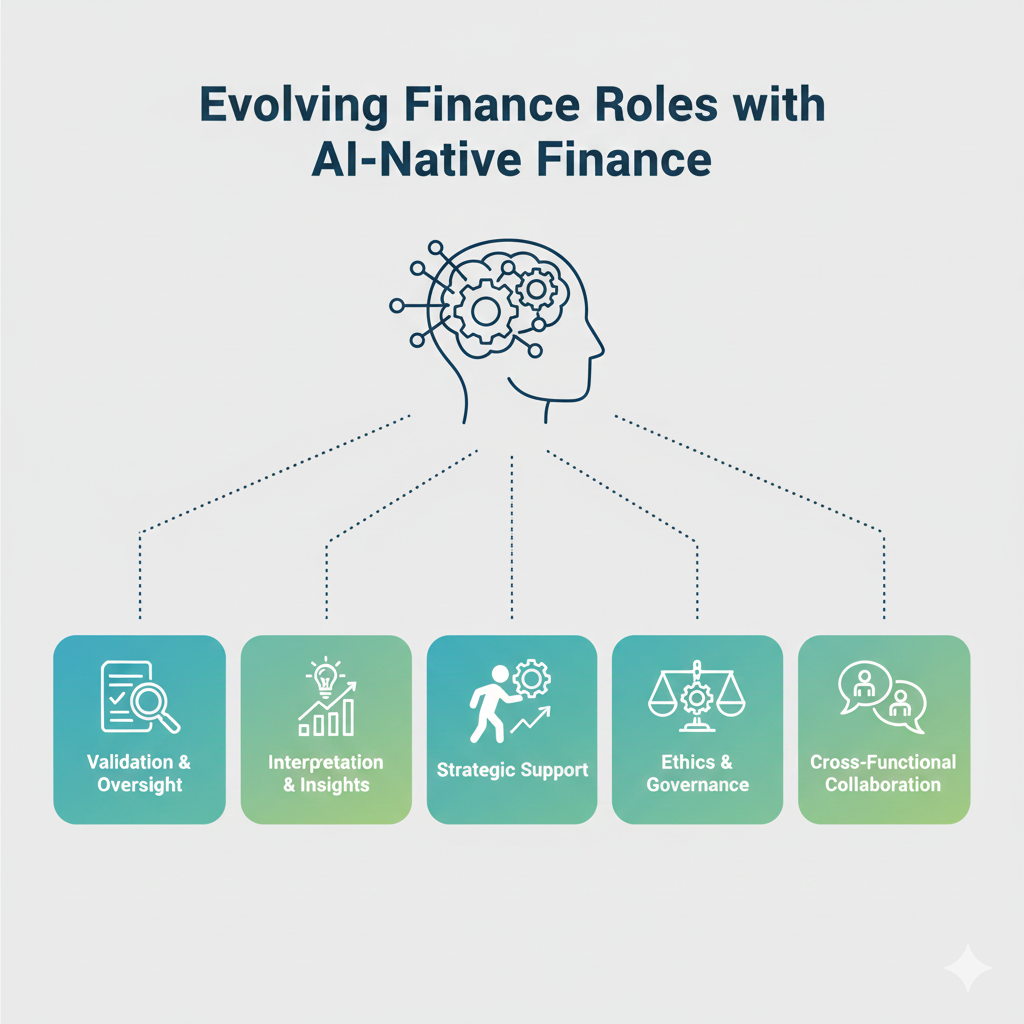

This approach also improves confidence in enterprise finance decisions by reducing reliance on static reports and manual reconciliation. As intelligence becomes embedded across finance technology trends, professionals can focus on validating insights, interpreting signals, and guiding strategic choices rather than chasing data accuracy.

Core Capabilities That Define Autonomous Finance

The following core capabilities outline what enables autonomous finance to function reliably across enterprise finance workflows:

- Continuous decision intelligence – Autonomous finance systems analyze data streams in real time, enabling earlier detection of liquidity risk, forecasting variance, and compliance issues. This supports more reliable planning and execution across finance workflows.

- Adaptive execution within governance boundaries – Actions are guided by policies, thresholds, and approval frameworks, ensuring autonomy does not compromise control. Human oversight remains central, especially for exceptions and ethical considerations.

- Integrated visibility across enterprise finance – By connecting treasury, accounting, planning, and risk functions, autonomous systems reduce blind spots created by fragmented tools.

- Learning-driven improvement over time – Self-learning finance models improve accuracy as they process new data, increasing value without constant reconfiguration.

Leveraging Predictive Analytics for Smarter Financial Decisions

AI financial operations rely heavily on predictive analytics to replace delayed visibility with forward-looking clarity. By continuously analyzing inflows, outflows, counterparty behavior, and settlement timing, autonomous finance platforms allow teams to anticipate funding gaps before they become operational issues.

The Bank for International Settlements has emphasized that predictive liquidity modeling materially improves risk assessment accuracy in environments with compressed settlement cycles. (BIS 2024)

Risk Management and Governance in Autonomous Finance

As finance functions adopt greater autonomy, governance becomes more critical rather than less. Transparent models, explainability, and clear accountability ensure that intelligent finance systems support trust rather than undermine it.

According to the CFA Institute’s 2025 report on explainable AI in finance, opaque decision‑making systems risk eroding confidence among regulators, risk managers, and end users, making explainability a top priority for compliance and risk oversight. CFA Institute

Strong data governance and security controls also remain essential, particularly as enterprise finance systems scale across jurisdictions with differing regulatory expectations, and firms must balance innovation with responsible AI adoption practices. CFA Institute Research and Policy Center

How Finance Evolves with Intelligent Automation

When autonomous finance is implemented across connected workflows rather than isolated tasks, the finance function gains clarity, reliability, and strategic relevance. Manual workload decreases, forecasting confidence improves, and decision timelines compress without sacrificing oversight. Finance professionals move into roles centered on validation, interpretation, and strategic guidance, strengthening their influence across the organization.

Preparing for the Next Phase of Finance Operations

Autonomous finance is not about removing human judgment, but about amplifying it with intelligent systems that operate continuously and responsibly. Organizations that thoughtfully embed AI in their financial operations position finance as a proactive partner to leadership, rather than a reactive support function.

Learn more about how intelligent, governance-ready platforms enable autonomous finance and support confident decision-making across modern finance operations through Fintropi.