Financial operations have always evolved alongside technology, yet many finance teams are discovering that incremental upgrades no longer deliver the clarity, control, or reliability required today. The growing complexity of transactions, tighter settlement timelines, and heightened regulatory expectations are quietly exposing the limits of traditional finance systems. This has led leaders to reassess how intelligence is embedded into operations, raising a critical question about whether current systems are equipped to support the next phase of finance transformation.

Evolution of Financial Operations: Then and Now

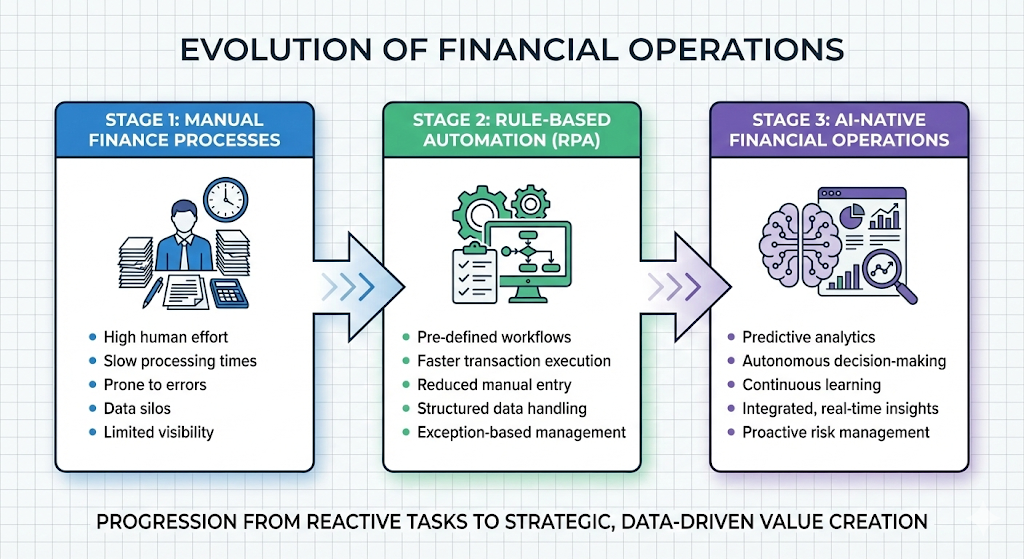

For decades, finance functions relied on structured processes supported by spreadsheets, ERP modules, and manual reconciliations. These systems were designed to record outcomes rather than interpret them, placing heavy dependence on human intervention. Over time, digital finance tools improved efficiency, but intelligence remained external to the system.

Today, expectations are shifting toward modern finance systems that can analyze, predict, and act within workflows. This transition reflects a broader move away from static reporting toward continuous insight, where decisions are informed by patterns rather than periodic reviews.

From Isolated Systems to AI-Enabled Finance Functions

Many organizations still operate with fragmented tools across accounting, treasury, and planning. These disconnected environments limit visibility and introduce delays that compound operational risk. Finance leaders increasingly recognize that intelligence must sit at the core of systems rather than operate as an add-on.

A recent survey showed that 59 % of finance organizations are using AI in 2025, with growing optimism about its value, and key use cases like knowledge management and anomaly detection. (Gartner)

This demonstrates that organizations are moving beyond incremental automation toward systems that can embed intelligence directly into workflows, improving decision-making and operational clarity. This principle underpins the rise of AI-native finance platforms.

Automation in Finance: Past Approaches and Present Limitations

Early automation initiatives in finance were primarily designed to improve consistency and processing speed. Rule-based systems and robotic process automation became widely adopted to standardize repetitive workflows such as invoice processing, reconciliations, and reporting tasks. These tools delivered measurable efficiency gains, particularly in stable environments with predictable inputs and well-defined rules.

However, these approaches were built for control rather than adaptability. As financial operations grew more complex, legacy automation revealed structural limits. Processes involving judgment, data gaps, or frequent exceptions continued to require manual intervention, reducing scalability and long-term impact.

According to McKinsey, traditional automation models struggle when workflows require contextual understanding or decision-making under uncertainty, which limits their ability to support resilient financial operations. (McKinsey) This constraint explains why financial operations automation alone often improves efficiency without delivering sustained insight or strategic value.

This limitation explains why financial operations automation alone often fails to deliver long-term resilience or insight.

Agentic AI and Its Role in Modern Financial Operations

Traditional Rule-Based Automation

Rule-based automation performs predefined actions with consistency, but it cannot interpret intent, evaluate trade-offs, or respond to unfamiliar conditions. When exceptions arise or policies evolve, workflows stall and require human escalation.

Over time, this increases operational friction and creates dependency on manual oversight, particularly as transaction volumes and regulatory complexity increase. While effective for narrow tasks, these systems remain reactive by design. They execute instructions accurately, but cannot reason across interconnected finance functions.

Intent-Driven AI Systems

Agentic systems operate with an understanding of objectives, constraints, and contextual signals across multiple data sources. Instead of following static rules, these systems evaluate conditions and determine appropriate actions aligned with defined outcomes. According to Deloitte’s 2025 finance and accounting survey, more than 42 % of finance professionals cited increased efficiency and productivity as key benefits of using AI agents, and a significant portion of organizations are already building or planning agentic AI implementations, underscoring momentum in autonomous finance adoption (Deloitte)

This capability enables autonomous finance, where systems assist decision‑making without removing human oversight. In financial operations, this delivers intelligent assistance rather than unchecked automation, ensuring that decisions are informed by real‑time data and policy frameworks while human professionals retain oversight and accountability

Cash Management Models: Historical Practices vs AI-Native Capabilities

Limitations of Traditional Cash Visibility:

Conventional cash management relies heavily on delayed reconciliations, periodic reporting cycles, and manual forecasting adjustments. This structure limits visibility into current liquidity positions and forces finance teams to rely on conservative buffers to manage uncertainty. As a result, working capital decisions are often based on partial or outdated information.

These constraints become more pronounced as payment volumes increase and settlement timelines compress.

Advantages of Predictive and Real-Time Insights

AI-native cash models continuously analyze inflows, outflows, counterparty behavior, and settlement timing. By applying predictive analytics, finance teams gain earlier visibility into potential liquidity risks and funding gaps, enabling them to plan strategically rather than reactively. According to a 2025 industry analysis, predictive analytics transforms cash flow forecasting by replacing error‑prone manual methods with data‑driven, real‑time insights that reduce forecasting errors by up to 50 % and help finance teams anticipate cash inflows and outflows with greater precision (Phoenix Strategy Group 2025). This is where AI‑native software delivers measurable operational clarity, supporting better working capital decisions and more proactive liquidity management.

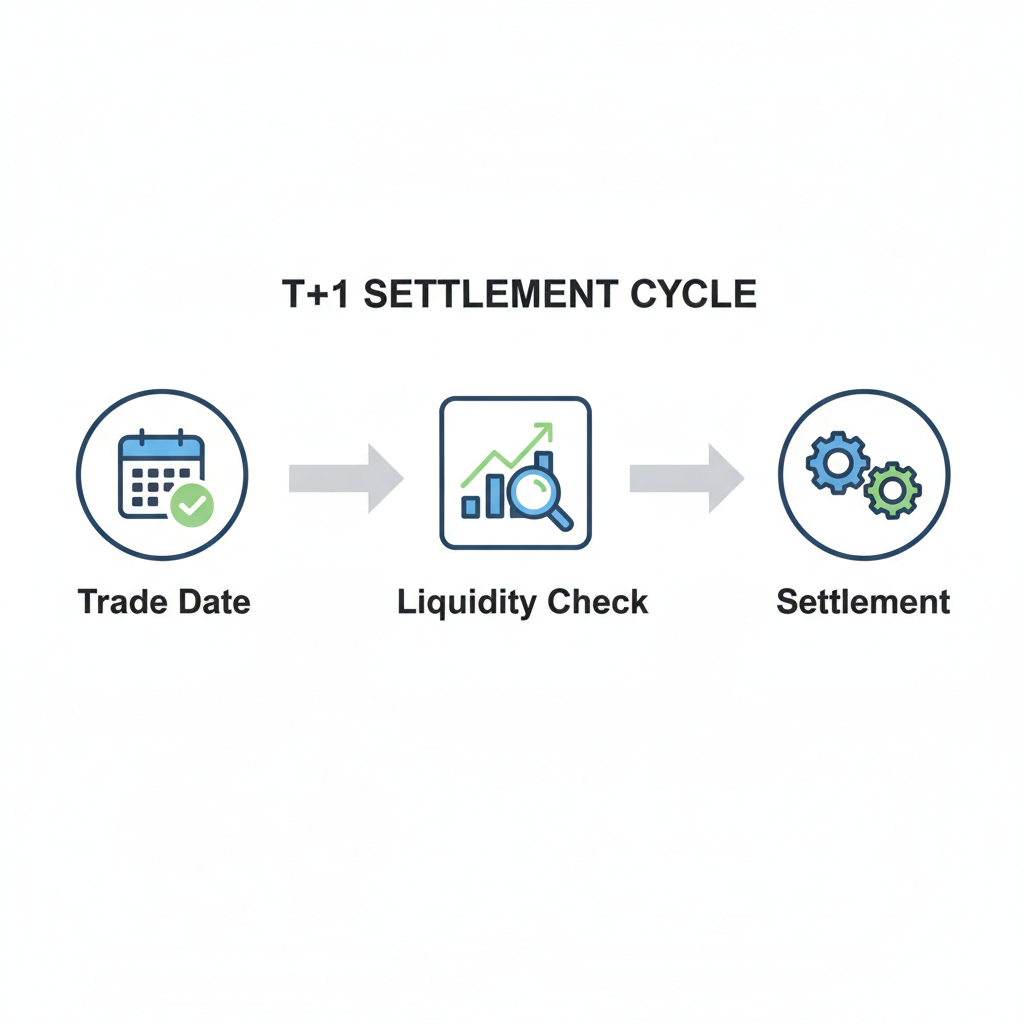

Operational Implications of T+1 Settlement Cycles

Shorter settlement cycles compress operational timelines and reduce tolerance for manual intervention. Finance teams must detect mismatches, funding gaps, and compliance risks almost immediately. Intelligent systems are increasingly essential to support reliability within finance innovation initiatives.

As a result, intelligent systems are becoming essential to support operational reliability, particularly within finance innovation programs focused on speed, accuracy, and compliance.

Governance and Risk Management in AI-Native Finance

Explainability, Bias, and Oversight

The CFA Institute emphasizes that AI-driven finance must remain explainable to ensure accountability and trust (CFA Institute). Transparent models allow finance leaders to validate outcomes rather than accept them blindly.

Data Security and Regulatory Considerations

AI systems depend on high-quality, well-governed data. Strong controls support compliance while enabling scalable finance transformation across regions and regulatory frameworks.

Changing Responsibilities of Finance Professionals

As intelligence becomes embedded within finance platforms, professional responsibilities increasingly shift away from transactional execution toward validation, oversight, and informed judgment. Finance professionals now spend more time ensuring the accuracy of system outputs, confirming alignment with policy requirements, and maintaining regulatory integrity across automated processes. At the same time, the role expands into interpretation and insight translation, as teams contextualize AI-generated signals into meaningful guidance for leadership, replacing static reporting with forward-looking analysis.

Routine automation also enables deeper involvement in strategic decision support, including planning, scenario evaluation, and capital allocation discussions that influence organizational direction.

Human judgment remains central in addressing ethical considerations, identifying potential bias, and managing risk exposure associated with intelligent systems. As a result, continuous skill development and closer collaboration with technology, risk, and Compliance teams have become essential to effectively govern and scale intelligent finance operations.

Challenges in Achieving ROI From AI Initiatives

• Fragmented implementation across finance functions- AI initiatives are often deployed in isolated workflows rather than across end-to-end financial operations, which limits their ability to influence outcomes such as forecasting accuracy, cash optimization, and risk reduction in a measurable way.

• Unclear alignment with business and finance objectives- Many AI programs focus on experimentation or technical capability without clearly mapping outcomes to CFO priorities such as working capital efficiency, compliance reliability, or cost control, resulting in limited executive confidence in return on investment.

• Data quality and integration constraints- Inconsistent data standards, legacy system dependencies, and incomplete data pipelines reduce model effectiveness and increase reliance on manual correction, which erodes the operational gains expected from intelligent automation.

• Limited change management and adoption readiness- Even well-designed AI systems underperform when finance teams are not adequately trained to interpret outputs, challenge recommendations, and integrate insights into daily decision-making processes.

• Governance and measurement gaps- Without clear ownership, explainability standards, and success metrics, organizations struggle to evaluate performance consistently, making it difficult to justify scaling AI investments across the finance function

Key Considerations for Transitioning to AI-Native Finance Operations

• Embedded intelligence as a foundation- AI delivers lasting value when integrated directly into finance systems rather than layered externally.

• Human accountability remains central- Autonomy works best when paired with professional oversight and governance.

• Data quality determines outcomes- Reliable inputs are essential for scalable digital finance performance.

• Governance enables sustainable scale- Clear policies support consistent adoption across expanding operations.

Conclusion: Preparing Financial Operations for the Next Phase

AI-native finance represents a shift toward systems that support clarity, reliability, and informed judgment across financial operations. Organizations that approach this transition deliberately position finance as a strategic function rather than a reactive one.

Explore how Fintropi enables AI-native financial operations through intelligent, governance-ready design.